Blogs

A Closer Look at WLPayments’ Enhanced Rules Engine

In the dynamic payment processing realm, WLPayments is excited to announce a significant leap forward by unveiling our upgraded Rules Engine. This enhancement promises to elevate your experience, offering transparency, efficiency, and security. Let’s delve into the tangible benefits of these improvements through examples.

Payment Orchestration: building blocks for a great performance

WLPayments now supports MPAN for seamless ApplePay tokenization flow

In a continuous effort to enhance the payment experience for its users, WLPayments, a leading payment gateway company based in Amsterdam, is thrilled to announce a significant feature update. WLPayments is now fully equipped to support Merchant Payment Account Numbers (MPAN) for a smoother Apple Pay tokenization flow.

Payment Orchestration: building blocks for a great performance

Introducing New Parameters in the Tokenization Payment Flow

In the fast-paced realm of online payments, the key to success lies in adaptability and innovation. At WLPayments, we pride ourselves on keeping abreast of industry changes and are thrilled to announce a significant update to our tokenisation payment process. This enhancement introduces new parameters, injecting greater flexibility and control into subsequent transactions.

Payment Orchestration: building blocks for a great performance

Unlocking Efficiency: Introducing WLPayments’ New User Administration Feature

We are thrilled to announce a game-changing addition to WLPayments – the User Administration feature! This enhancement is designed to give our partners unparalleled control over their merchants and employee accounts, elevating the management process to new heights of efficiency and ease.

Payment Orchestration: building blocks for a great performance

Optimising Payment Notifications: The Multifaceted Webhook Solution

Effective Notifications are paramount in the ever-evolving landscape of online transactions and business interactions. Understanding webhooks’ crucial role in facilitating seamless communication between our partners, merchants, and their digital ecosystems is important. That’s why we are thrilled to introduce our latest innovation: the Multifaceted Webhook Solution.

Payment Orchestration: building blocks for a great performance

Unveiling the Power of Omission Reporting in Online Payment Management

In the ever-evolving landscape of online transactions, an unyielding commitment to precision and oversight is paramount for the financial departments and the individuals responsible for online payments with e-commerce merchants. Faced with the intricate dance of digital exchanges, one question surfaces: Have you ever grappled with a failed capture attempt or yearned for a comprehensive lens on unreconciled transactions?

Payment Orchestration: building blocks for a great performance

Exploring WLPayments Virtual Terminal: Simplified Payment Processing for Businesses

In the rapidly evolving landscape of e-commerce and digital transactions, businesses of all sizes are seeking efficient and secure payment processing solutions. WLPayments Virtual Terminal stands out as a transformative solution, providing a simplified approach to payment management, improving customer experiences, and streamlining operations.

Payment Orchestration: building blocks for a great performance

How A Company Achieved Global Expansion with Payments Orchestration

Read the story of a merchant associated with a certain company. Within this organization, there has been a strong determination to extend their business operations worldwide and explore untapped markets. However, as they embarked on this ambitious journey, they faced several obstacles, particularly in the area of processing payments. Thankfully, their choice to adopt payment orchestration proved to be a game-changer, revolutionizing their approach and empowering them to surmount these challenges. In this article, we will share how payment orchestration played a vital role in the company’s triumphant journey of global expansion.

Payment Orchestration: building blocks for a great performance

Hassle-Free Technical Integrations – Fiction or Reality?

In the dynamic world of eCommerce, one truth remains constant – payment supplier integrations are a necessity for every online merchant. Nevertheless, these integrations frequently come at a substantial cost. Merchants not only have to establish connections with payment suppliers but also have to consume the provided data and integrate it into their systems, such as Enterprise Resource Planning (ERP) systems. This process plays a vital role in efficiently managing orders, billing, customer support, and other essential aspects.

Payment Orchestration: building blocks for a great performance

Payment Orchestration: building blocks for a great performance

In our earlier blog post about Payment Orchestration, we explored the idea that Payment Orchestration encompasses more than just transaction routing. It entails a successful fusion of various components, features, and advantages. Continuing from our initial blog, this article delves deeper into the elements that collectively contribute to the effectiveness of Payment Orchestration.

Payment Orchestration: building blocks for a great performance

Payment Orchestration is more than just Transaction Routing

With the growing significance of online payments for businesses globally, it is crucial to possess a dependable and streamlined payment gateway capable of handling various payment methods, currencies, and jurisdictions. This is where Payment Orchestration steps in. Payment Orchestration serves as a solution that empowers businesses to effectively and efficiently manage their online payments.

3DS1 sunset is approaching fast

Starting from October 15th, the primary card networks will sunset the usage of 3DS 1.0 and exclusively support EMV 3DS 2.1 or newer protocols. To maintain competitiveness, merchants must upgrade to 3DS 2.2. This upgrade will enhance security and provide customers with a superior payment experience. Additionally, it will offer merchants the advantage of stronger protection against fraud and chargebacks, as well as reduced instances of cart abandonment.

The secret to a higher risk appetite while safeguarding your MIDs and lowering the chargeback costs

One of the primary worries for online merchants is effectively managing their chargeback ratio. Card schemes closely monitor merchants’ chargeback ratios, and if merchants and acquirers surpass a specific threshold, a warning is issued. Initially, merchants may face fines or be enrolled in chargeback mitigation programs. Ultimately, there is a risk of losing their Merchant IDs (MIDs) and ceasing credit card processing. However, before reaching that point, it is likely that the acquirer intervenes by freezing the MIDs, effectively suspending merchants from conducting any further transactions.

Payment priorities for the forex industry

In this blog post, we will explore the essential solutions that Forex brokers should seek when evaluating potential payment gateway partnerships. Due to the large transaction volumes associated with the Forex industry, there is a heightened risk of fraudulent activities targeting insecure payment processes. Moreover, the Forex market encounters a significant number of chargebacks, which contributes to its classification as a high-risk sector by card schemes. Therefore, it is crucial for Forex brokers to establish partnerships with payment gateway providers who possess a comprehensive understanding of the market and the specific concerns faced by industry participants.

An introduction to 3DS Exemptions

When it comes to online payment transactions, ease of use and enhanced security are two crucial aspects. Taking this into consideration, Strong Customer Authentication (SCA) was introduced as a regulatory requirement in the EU from January 2021 and enforced in the UK by March 2022. SCA operates on the principle of establishing trust and encourages merchants to enhance their customers’ transaction rate and volume, ultimately reducing the need for multiple authentication steps during the process. This approach aims to strike a balance between ensuring security and providing a smoother payment experience.

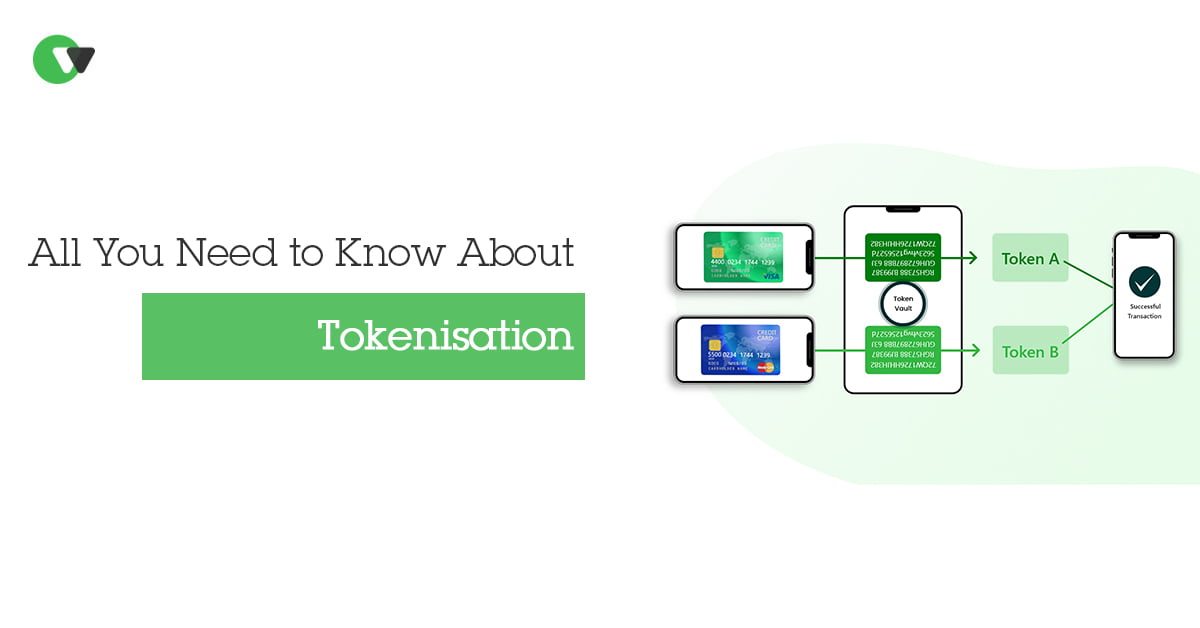

All you need to know about Tokenisation

In simple terms, tokens are randomized values that serve as substitutes for important information, such as a person’s social security number. Meanwhile, the original sensitive data remains securely stored outside the internal systems of a business.

A helpful analogy to grasp the concept is to compare tokens to poker chips. Instead of having a large sum of cash directly on the table, players use poker chips. If these chips are stolen, they hold no value in the real world; they can only be used when exchanged for their representative worth. Tokenization works similarly by removing valuable data from your current environment (like removing cash from the poker table), securely storing it in a separate cloud environment (like the chip dealer), and replacing it with tokens (providing players with poker chips instead).

All you need to know about payment orchestration

The objective of payment orchestration platforms (POPs) is to integrate and streamline the various disjointed components of the payment landscape, including payment service providers (PSPs), acquirers, banks, risk management, analytics, and regulatory compliance, into a unified ecosystem. In simpler terms, payment orchestration platforms are responsible for managing every aspect of the payment processing cycle, from validation and routing to settlement, utilizing cutting-edge technology and advancements in the field. By handling the intricacies of payment processing, they enable merchants to dedicate more time to their primary business operations.

Trends in Global Payments for 2022

As we step into the new year while still navigating through the ongoing pandemic, it is crucial for payment companies to anticipate forthcoming digital payment trends and proactively strategize. To accurately forecast customer behaviors and preferences, it is essential to closely monitor the prevailing economic climate, the impact of the pandemic, and the advancements in digital payment technologies. However, given the multitude of new payment tools, regulations, and financing options, planning the next steps can feel overwhelming for both merchants and payment companies. To simplify matters, we have outlined the most significant changes and anticipated digital payment trends expected to shape the payment industry in the coming year.

The Future of iGaming Payment Processing – How your company can adapt to it.

Companies within the iGaming industry are well aware of the highly competitive market in which they operate, leaving no room for neglecting any aspect. Fast, convenient, and secure payment solutions are essential pillars of iGaming platforms, and as a result, they have been at the forefront of innovation. In this article, we explore intriguing advancements in payment processing within the iGaming industry that not only pave the way for the future but also highlight certain challenges that may arise along the journey.

Traditional Banks vs. Modern Fintechs

The introduction of technology has ushered in groundbreaking innovations across various industries, including the financial sector. An impactful outcome of this innovation is the emergence of modern fintech companies that offer efficient financial services supported by cutting-edge technology to a diverse customer base. This article explores the potential competition between traditional banks and modern fintech firms—whether they are genuinely competing or if there is an opportunity for them to collaborate and strengthen the financial services sector as a whole.

Difference between a payment gateway and payment processor

Before we delve into the details, it is crucial to comprehend the process of completing an online payment in order to better understand the role played by each involved component. There are essentially five entities involved in such transactions. These include:

- The merchant – This party provides a service or product that potential customers are interested in purchasing. The relationship between the merchant and the customer seeking to make a payment serves as the starting point for an online payment transaction.

- The customer – The next party is the customer themselves. They initiate the transaction by selecting the desired products or services for which they wish to make a payment. Subsequently, they enter the necessary payment information.

How We Built WLPayments With Interns

As a startup, our expectations revolve around accomplishing tasks within hours and days rather than weeks and months, emphasizing speed and efficiency in all aspects of our operations. Interns play a crucial role as they are in a phase of their careers where they transition from academia to the professional world. They possess a strong eagerness to learn and develop. Consequently, we have discovered that hiring interns is an excellent approach to expand our team and foster a culture that encourages rapid learning and creativity. With proper guidance, millennials have the ability to swiftly acquire new skills, apply them within short timeframes, and adapt to rapidly changing circumstances.

Six Payment Priorities for the iGaming Industry

In our earlier blog post, we delved into the significance of combating fraud in the iGaming sector. Nonetheless, it is crucial to emphasize that solely implementing fraud prevention tools is insufficient. To ensure a seamless payment experience aligns with robust compliance measures, fraud management must collaborate with efficiency-enhancing solutions. Therefore, this blog post will examine the diverse payment solutions and features that serve as vital complements to anti-fraud measures within the iGaming industry.

Efficient Payment Fraud management in the iGaming space

Having fast and secure payment transactions is the utmost crucial aspect for any iGaming business. These games, such as poker, casino games, bingo, lottery, and sports betting, revolve around generating revenue. The iGaming industry demonstrates fierce competition, particularly in major markets like the UK, Italy, and Sweden. Notably, the United States is undergoing a structural transformation, with Goldman Sachs analysts predicting a significant increase in the domestic iGaming market size from $1.5 billion presently to $14 billion by 2033, representing a 27% compound annual growth rate (CAGR) compared to the 18% E-Commerce benchmark. As reported by the Financial Times, the legalization of sports betting has commenced in various US states, with New York being the largest state to recently take this step. Moreover, Michigan, New Jersey, and Pennsylvania have emerged as significant individual markets on a global scale. However, these remarkable market growth rates have also attracted the attention of cybercriminals.

Payment innovations in the Online Dating space

In the past, people primarily relied on friends, family, universities, jobs, or similar intermediaries to meet new individuals. However, the internet, particularly dating apps, has revolutionized the way people connect and find their significant others. These apps have witnessed a remarkable surge in popularity, fundamentally altering the landscape of romantic encounters. The projected revenue for the dating app market in 2021 is estimated to reach US$3.241 billion, underscoring its significance. Just like any other industry in this digital era, innovation is imperative for dating apps to sustain competitiveness. Constantly updating their services and technology becomes a necessity. While some dating apps offer free access with optional paid features, others operate on a subscription-based model. Both models possess advantages and disadvantages, but neither can overlook the importance of keeping pace with payment trends.

Payment innovations in the Crypto Currency space

With the constantly changing landscape of the cryptocurrency ecosystem, merchants dealing in crypto may encounter difficulties in achieving growth and staying competitive. Expanding their operations poses numerous challenges, including combating fraud, incorporating new payment methods, and streamlining the customer experience to eliminate obstacles. This is why establishing a partnership with a suitable payment platform that provides cutting-edge payment solutions becomes vital for the sustained success of a crypto company. The purpose of this blog is to delve into the different payment innovations that crypto companies should be aware of and examine the advantages these solutions can bring to their business.

2020 – A year of digital payments

This month commemorated the one-year milestone of coronavirus lockdowns implemented across numerous European countries. Since then, our interactions, work routines, and even payment methods have undergone significant transformations. As a payments company, we find the latter particularly intriguing to explore. Hence, this blog aims to examine the influence of the coronavirus on people’s payment behaviors and determine if these changes are enduring. With the pandemic’s conclusion on the horizon, it becomes crucial to identify which consumer preferences and payment trends are likely to persist and shape the future as part of the “new normal.”

Pay-by-Link: All You Need to Know

The primary objective of payment solutions is to offer customers a secure and smooth checkout process while simultaneously boosting the conversion rates for merchants. Pay-by-Link serves this purpose by providing shoppers with an expedient alternative payment option. Therefore, comprehending the functionality of Pay-by-Link becomes crucial as it holds significant advantages for merchants across various industries.

Frictionless 3DS2.2 Implementation- The Solutions

In our previous blog post on 3DS2 implementation (which you can find here), we explored the primary obstacles and emphasized the significance of a well-executed implementation. In this subsequent blog, we will shift our focus to the solutions and delve into specific measures that can be taken to ensure a seamless implementation process.

Frictionless 3DS2.2 Implementation- The Challenges

The implementation deadline for PSD2’s Strong Customer Authentication (SCA) has been widely covered in the news recently. Undoubtedly, this regulatory milestone holds significant importance within the market. However, the substantial attention it has garnered can also be attributed to the emerging challenges associated with the implementation of 3DS2. While transitioning from 3DS1 to 3DS2 brings numerous benefits, the implementation process itself can be intricate and pose various obstacles. Therefore, it is essential to examine these key challenges and emphasize the importance of achieving a seamless implementation of 3DS2.

Using Payment analytics and insights to grow your business

In the present time, organizations have unprecedented access to vast quantities of data that can be utilized to their advantage. This era of big data and analytics has empowered merchants to make more strategic and well-informed operational decisions. However, the realm of payments has often been overlooked in terms of data optimization. While investing in analytics for areas like marketing is more prevalent, it is crucial not to underestimate the potential impact of payment data and insights. With the surge in online transactions, there couldn’t be a better moment to explore the utilization of comprehensive reporting features for online payments. This will not only enable merchants to significantly reduce costs but also generate higher revenues. Let us delve into the methods through which this can be accomplished.

WLPayments announce their addition of 7 new acquirers in the span of just 2 months

WLPayments is pleased to announce its addition of 7 new acquirers to its platform, keeping true to its acquirer-agnostic approach. These acquirers were integrated within 2 months, validating WLPayments’ method of planning in terms of hours and days rather than weeks and months.

Most popular payment methods in LATAM

While Latin America may not possess the largest e-commerce market, with a valuation of only 200 billion, it is undeniably a captivating market worth exploring. In fact, according to a study by EBANX, LATAM stands as the second-fastest-growing e-commerce market globally, trailing only behind the Asia-Pacific region. Consequently, it offers substantial growth prospects for visionary businesses and serves as an intriguing territory to delve into for our “Most Popular Payment Methods” series.

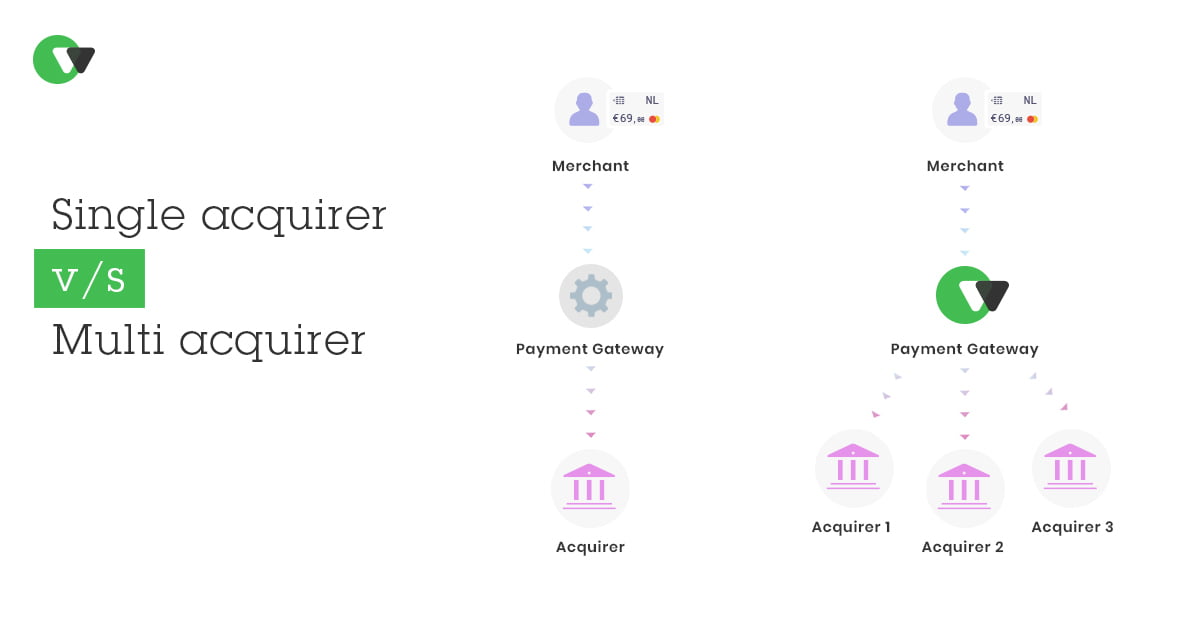

Multi Acquirer v/s Single Acquirer: Which to choose?

The acquirer-specific approach is a more conventional approach where a merchant collaborates with a single acquirer. Often, the gateway’s relationship with the merchant makes it obligatory to follow this approach. In this scenario, the gateway directs all transactions exclusively to the partnered acquirer. While these gateways are often capable of offering an efficient Payment Orchestration layer to merchants, they have strong incentives not to do so.

6 things you need to know about payment integrations

Effective integrations play a crucial role in establishing a successful payments strategy, considering the multitude of participants involved in online transactions. Chetan Chadha is leading the Integration Team at WLPayments. Chetan’s team is highly regarded and esteemed in the industry for their exceptional proficiency in conducting integrations with the utmost quality and efficiency. To gain further insights into this subject, we conducted an interview with Chetan, and here are his valuable remarks:

Things to consider when expanding to different countries

With the economy increasingly shifting towards digitalization and cross-border connectivity, there is a consistent upward trajectory in global eCommerce. Merchants are actively seeking innovative methods to establish trust among their global customer base, which requires fast, dependable, and convenient payment solutions. Although the process may appear straightforward at first glance, optimizing cross-border transactions demands significant effort. This includes incorporating local payment methods, implementing a robust fraud prevention system, integrating with multiple acquirers, and allocating time for intricate reconciliation procedures.

Most popular payment methods in the Nordics

The Nordic countries in Europe have gained widespread acclaim for their remarkable modernity and digital proficiency. Within the payments industry, it is widely believed that these nations will lead the way in becoming the first “cashless” societies, underscoring the paramount significance of digital payments in the region. This sentiment is reinforced by the noteworthy statistic that 84.65% of Swedes engage in online shopping, positioning them as the foremost population globally in embracing e-commerce. Additionally, according to the same report, Norway holds the distinction of being the second-largest e-commerce market in terms of revenue per shopper. Therefore, it comes as no surprise that the Nordics present an enticing prospect for cross-border merchants, making it imperative to familiarize themselves with the local payment methods in order to successfully expand into these technologically advanced nations.

Split Payments; Going Dutch

With the ongoing transition from brick-and-mortar establishments to online stores, customers are seeking convenient methods to split payments when making group purchases. Especially when it comes to shared expenses such as gifts or group travel, the financial burden can be too substantial for a single individual to bear alone. Therefore, it is crucial for merchants to incorporate a payment solution that enables the division of costs among multiple participants within a single transaction. This is precisely where our innovative offering, Split Payments; Going Dutch, comes into action.

One-click Payment in the Modern E-commerce Ecosystem

In the modern era, individuals are consistently seeking the fastest and most convenient methods to accomplish their tasks. This inclination towards efficiency extends to the realm of payments, encompassing online shopping transactions and gaming top-ups. The younger generation of consumers, in particular, expects a seamless experience during their online shopping endeavors, and it is the responsibility of e-commerce players to meet these expectations. This is precisely why merchants should contemplate enhancing their checkout process through the implementation of One-click Payment, ensuring a streamlined and hassle-free experience for their customers.

5 Key Steps to facilitate the security of a payment platform

WLPayments, a reputable global payment platform offered under a white-label model, offers merchants the opportunity to operate and oversee their own platform without the burdensome task of constructing the underlying infrastructure. In addition to offering various solutions that enhance conversion rates, our payment gateway boasts a vital attribute: security. Recognizing the paramount importance of providing a secure payment process, we recently conducted an interview with Lovepreet Singh, the Infrastructure Lead, to delve into the challenges associated with maintaining and safeguarding the infrastructure of a payment platform.

The Evolution of Cashless Payments

Since the onset of the pandemic, there has been a significant surge in e-commerce operations. According to Adobe, the growth of e-commerce has been expedited by a staggering 4 to 6 years and is anticipated to persist even during the anticipated “second COVID-19 wave”. The Shopping Index data from Salesforce further reinforces this trend, revealing a remarkable year-over-year increase of 71% in global online sales revenue during the second quarter of 2020. On one hand, this shift in consumer purchasing behavior has had a profound impact on traditional brick-and-mortar retail stores, which continue to grapple with survival challenges.

White Label Payment Gateway: More Pros and Less Cons

Having the right partner to assist you with payments is a significant advantage for your business. In today’s digital era, where online payments are becoming increasingly prevalent, it is crucial to ensure secure and efficient transactions. A White-Label payment gateway presents a solution that enables Payment Service Providers (PSPs), Acquirers, Independent Sales Organizations (ISOs), and online merchants to process payments while maintaining their own unique identity through third-party services.

By integrating their company’s logo and colors with payment processors, a White-Label payment gateway allows payment companies to personalize the solution and process transactions using a third-party gateway provider.

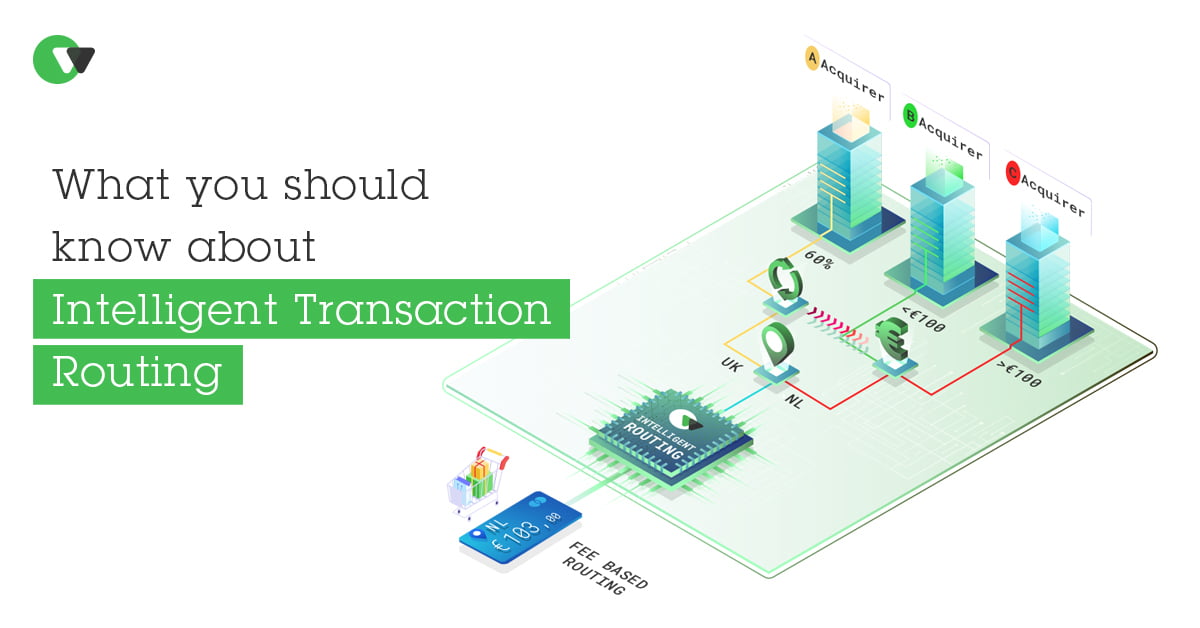

What you should know about Intelligent Transaction Routing (ITR)

According to Statista, e-commerce is projected to represent 18.1% of global retail sales in 2021, marking one of the highest percentages in a single year. While international e-commerce provides numerous prospects for expanding global business, it also entails a fiercely competitive market. Online merchants encounter various challenges, including the need to optimize payment success rates, reduce transaction costs, and ensure redundancy throughout the payment process. In recent years, Intelligent Transaction Routing (ITR) has emerged as a technology of increasing interest, offering a potential solution to these challenges.

Why you should care about Digital Wallets

According to the Worldpay annual payments report, digital wallets are projected to become the leading online payment method by 2023, capturing a market share of 52%. This shift is primarily fueled by the increasing digitization of transactions and the widespread adoption of smartphones.

A digital wallet serves as a payment system for conducting e-commerce transactions. Typically, individuals link their bank accounts to digital wallets, which securely store their user credentials and banking information. Digital wallets offer the convenience of making both online and in-store payments at establishments that accept mobile payments. Prominent examples of popular digital wallets include Apple Pay, Google Pay, PayPal, Venmo, and AliPay.

Most popular payment methods in the five largest EU e-commerce markets

The e-commerce industry in Europe is experiencing rapid expansion, witnessing a 13% growth in 2019 compared to the previous year. Furthermore, 23% of e-commerce transactions are now crossing national borders, highlighting the increasing trend of cross-border online shopping. The impact of the coronavirus crisis has further emphasized the significance of digital payments, prompting businesses to reassess their online presence.

With this digital growth and external pressures, there are ample opportunities for expansion. However, it is essential to have an understanding of the prevailing payment methods in different markets. Ultimately, customers must be able to complete transactions and pay using their preferred payment methods.

Frictionless payments vs Fraud mitigation

With the continuous evolution of the E-commerce sector, the occurrence of fraud is on the rise, accompanied by increased sophistication. It is clear that effective fraud management holds increasing significance for businesses aiming to stay ahead in this constant game of cat and mouse. In this article, we will delve into the primary challenges linked to fraud prevention and explore the relevant tools that your business can adopt to mitigate the associated risks.

The Journey Doesn’t Stop at the Payment Page

Significant effort is dedicated to driving visitors towards the payment page.

In the realm of e-commerce, companies are constantly striving to enhance their conversion rates. This entails a range of tasks, such as testing the effectiveness of Google Advertisements, creating seamless and visually engaging landing pages, and crafting persuasive and high-converting content. Content writers, online marketers, SEA specialists, and other professionals play a crucial role in these endeavors.

5 things a CTO wants to know about outside solutions

The role of the Chief Technology Officer (CTO) in maintaining a top-notch payment platform was discussed by the CTO of WLPayments.

With the rapid evolution of the payments industry, CTOs are facing increased pressure to stay abreast of the changes while managing their regular responsibilities. We had the opportunity to interview Chinmay Jain, the CTO of WLPayments, to delve into these emerging challenges faced by CTOs and explore the solutions that payment platforms can provide to streamline their work.

Reconciliation and its importance

No matter the size of your business, reconciliation remains a significant accounting concern that consumes considerable attention from finance teams.

In this article, we will explore the significance of reconciliation for your company and delve into the key challenges inherent in this crucial internal control mechanism.

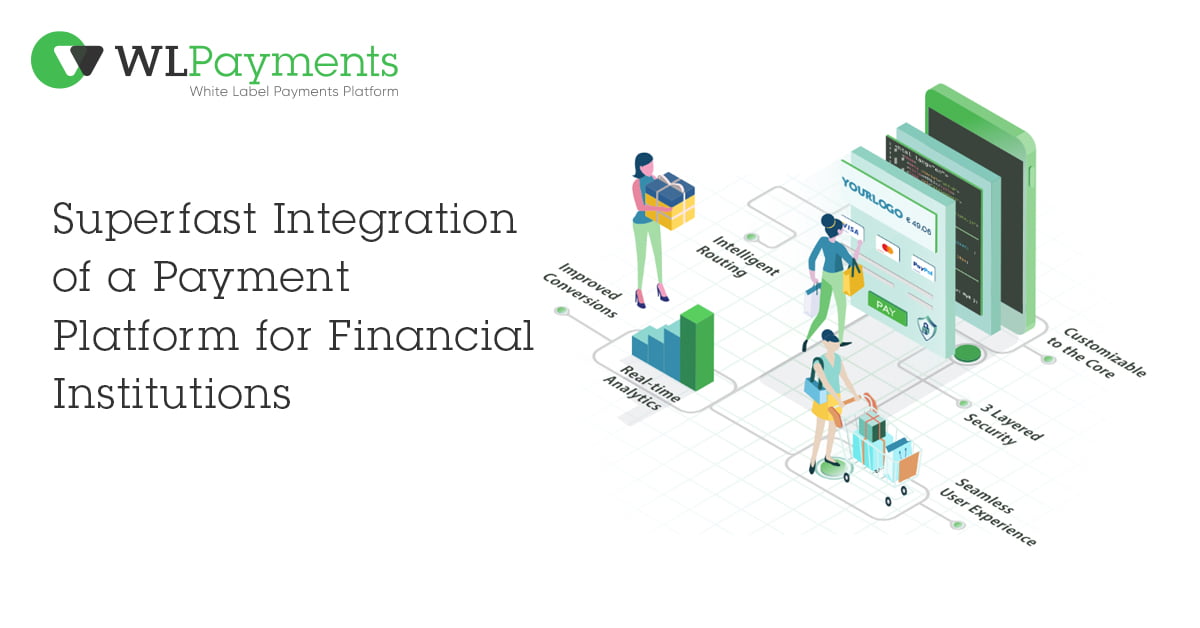

Superfast Integration of a Payment Platform for Financial Institutions

WLPayments made its official debut at the Webwinkel Vakdagen event. Within the past three months, we are delighted to have established partnerships with four new entities.

We purposefully refer to these entities as partners rather than customers, as we emphasize a collaborative approach to developing solutions and implementing them together.

WLPayments is a ‘Start Up to watch’ in The Paypers report: Who’s Who in Payments 2020

In the latest edition of Who’s Who in Payments, we were honored to be recognized as one of the “Startups to Watch in 2020.” They conducted an interview with our CEO, Sunil Jhamb, to delve into how WLPayments is revolutionizing the market for managed payment platforms catering to PSPs, ISOs, acquirers, and banks.

By prioritizing seamless integrations and tailoring solutions to meet clients’ specific requirements, WLPayments serves as an ideal partner for busy IT departments immersed in long-term projects. Equipped with a comprehensive suite of APIs, plug-ins, and wrappers, IT departments can play a pivotal role in creating solutions that align with the growth objectives outlined by product managers.

WLPayments adds 10 new processors within 4 months

In WLPayments has achieved a significant milestone in providing merchants with a complete acquirer agnostic payment gateway platform. The company has integrated the following global processors to their payment gateway solution:

GDPR 101: The Basics

GDPR, which stands for General Data Protection Regulation, is a new set of data protection laws implemented in Europe. It aims to ensure responsible handling of personal data by companies and authorities, safeguarding the privacy and personal information of individuals from misuse or exploitation. GDPR replaces the previous Data Protection Directive of 1995, which was not designed to address the current data usage facilitated by the internet and services like Facebook and Google. The introduction of GDPR emphasizes the importance of handling personal data appropriately and encourages the development of data-centric designs. This regulation applies to all companies and organizations, both within and outside the European Union, that process the data of European citizens.