The secret to a higher risk appetite while safeguarding your MIDs and lowering the chargeback costs

Merchants benefit from the WLPayments’ machine learning-powered chargeback module through its partnership with EthocaTM

What risks do merchants run with chargebacks?

Managing their chargeback ratio is one of the biggest concerns for online merchants. The card schemes monitor merchants’ chargeback ratios, and a warning goes out when the merchants and acquirers exceed a certain threshold. First, the merchants get a fine or get submitted to a chargeback mitigation program. Ultimately, the merchants risk losing the MIDs and stopping their credit card processing. But before that happens, chances are that the acquirer has stepped in and frozen the MIDs, effectively halting the merchants from doing any transactions.

Besides losing the MIDs and fines, we see costs as a significant factor in managing the chargebacks. Acquirers charge anywhere between €20 to €100 per chargeback.

In many cases, the costs of handling and possibly fighting these chargebacks are higher than the actual purchase value; not to mention, it can take up a lot of resources. Recent research by Justt estimated that the true cost of a €100 chargeback stands at €240. A table below breaks down the hidden costs of fighting the chargeback on a €100 purchase.

For some merchants, the cost of chargebacks adds up to hundreds of thousands of euros. And with the present scarcity of qualified personnel, merchants tell us that in some cases, they cannot handle chargebacks at all.

Lastly, there is the continuous risk-reward trade-off in marketing methods. With a low chargeback ratio, merchants can take more risks on the source quality of their leads. Usually, these leads are a bit cheaper and have a higher risk of chargebacks. The proper chargeback tools can thus lead to a higher return on marketing investment.

How can merchants minimise chargeback costs and safeguard their MIDs?

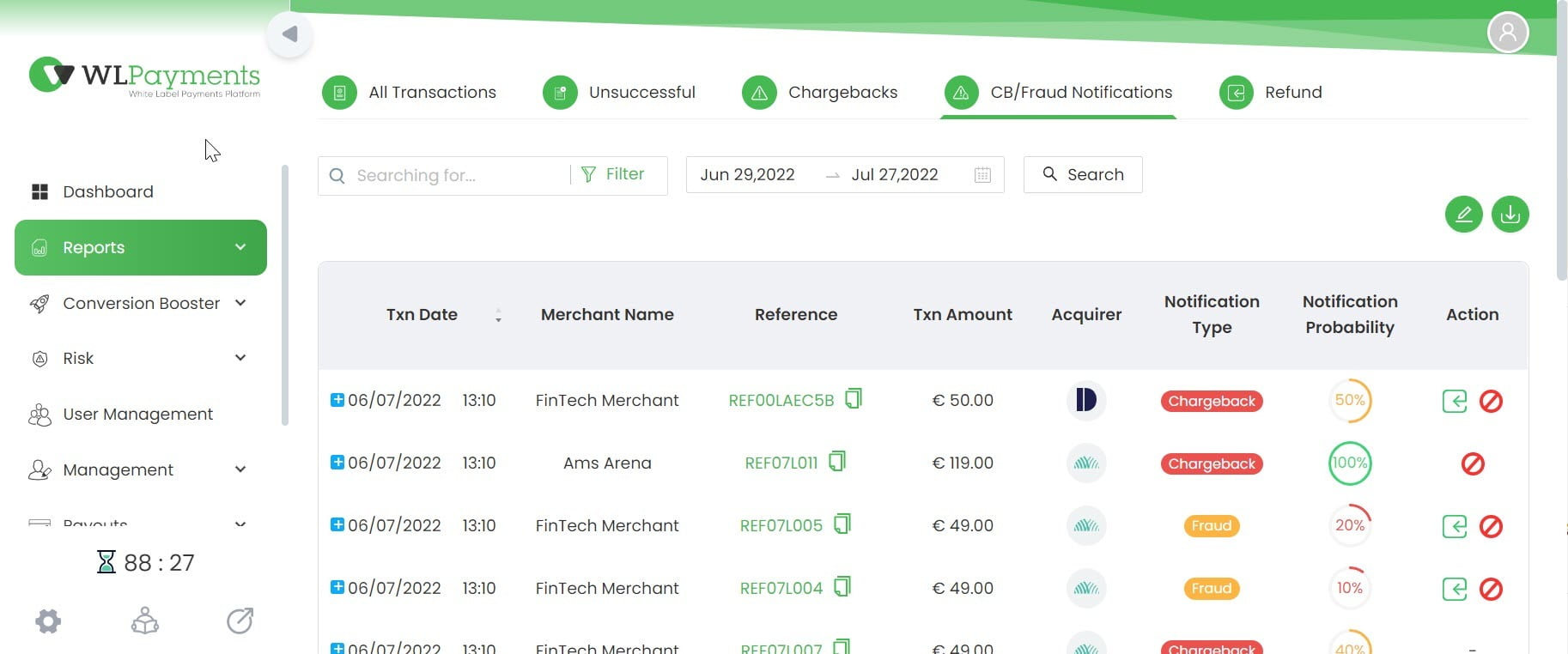

For merchants, preventing chargebacks can lead to substantial cost savings. Therefore, they need to understand the reasons behind them. It is even better if the merchants are notified that a chargeback will likely be submitted before it even happens. These dispute notifications allow the merchants to refund the transactions before the chargebacks are raised.

Dispute notifications can prevent a lengthy arbitration process and a lot of costs.

Biggest hurdles in managing the disputes and chargebacks

Big merchants have tools to help them with their chargeback management. Often they receive dispute notification before a chargeback is raised. They use this information to find the transaction associated with the dispute in their payment gateway and acquirer portal. With thousands of transactions and relatively limited information available, this search can be a cumbersome process. Furthermore, merchants need extra relevant transaction data to decide whether to fight a potential chargeback or do a refund instead. The time window before a dispute notification changes into a chargeback is usually less than 24 hours. This all requires human intervention and is usually done by specialists that know their way around different tools and payment data. In short, this work doesn’t come cheap.

Even when merchants have all these specialists and tools in place, it doesn’t end there. Workers are never around 24/7; they might take time off and miss important things. So, this work is prone to mistakes, sometimes costly.

Preventing new chargebacks is an inseparable part of chargeback management

The issuer sends a Chargeback reason and other payment data that can help merchants take action to prevent future chargebacks. Merchants can blacklist specific elements like the customer’s email and IP- addresses or credit card numbers. Again, this is a tedious chore for a specialist as they want to avoid blocking any future transactions that are entirely legitimate.

Now merchants can manage disputes, chargebacks and blacklisting automatically, all from one portal only

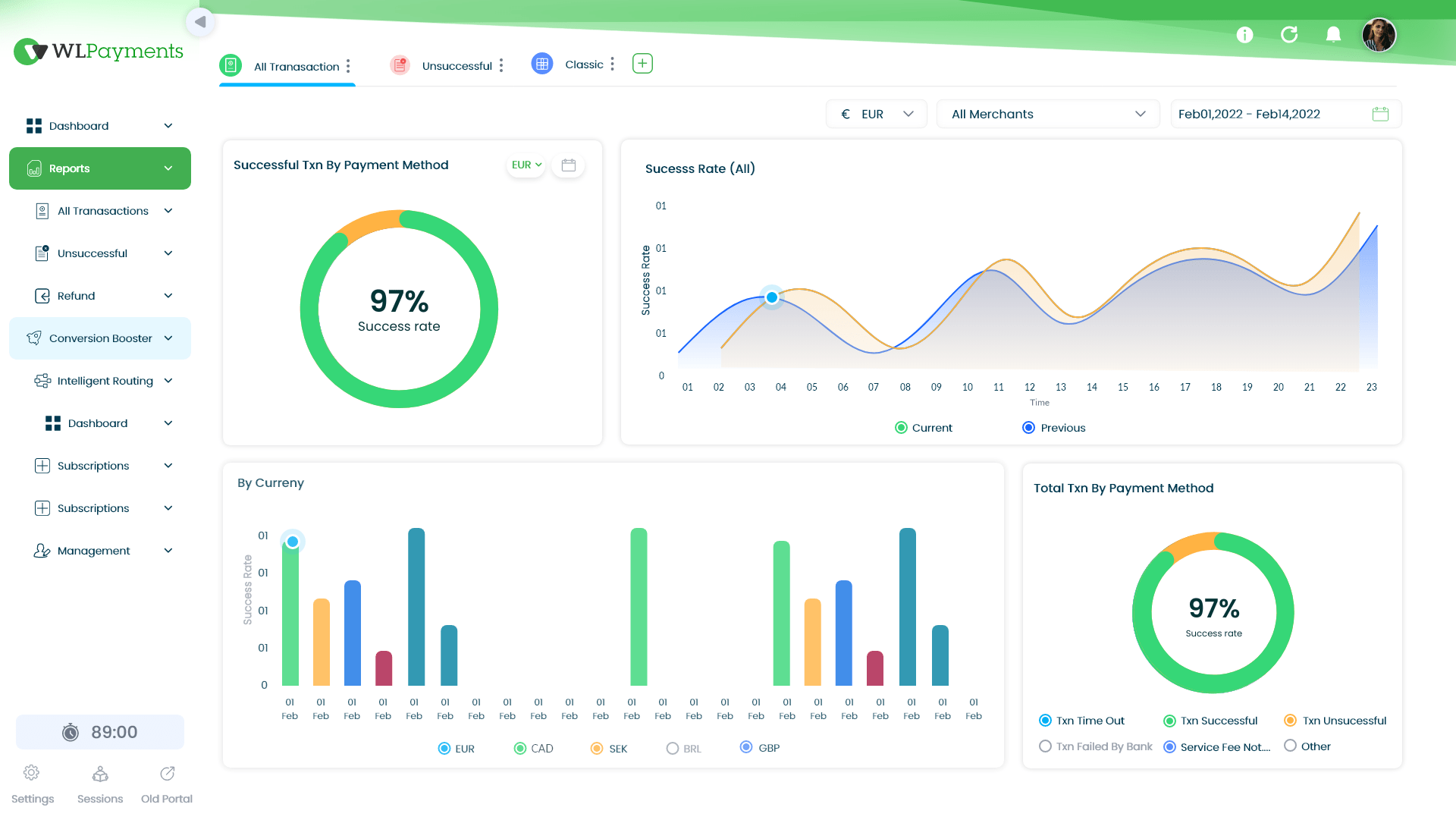

Through the partnership with EthocaTM, WLPayments offers its merchants direct access to all the relevant and enriched chargeback data directly in their merchants portal.

From now on, merchants no longer have to slice and dice the data, nor do they need to collect information from multiple systems in managing the chargebacks. Thanks to machine learning technology, merchants can get advice, set rules, and execute refunds and blacklisting fully automated. The advantages for the merchants are clear: no human error, lower costs, and a higher risk appetite all lead to a higher return on investments.

WLPayments’ merchants and partners now have access to the following services:

- Chargeback panel: Access chargeback alerts and notifications in one place with actionable insights

- Chargeback prevention: Auto-refund a transaction to safeguard a chargeback

- Chargeback guard: Fight chargebacks with ease by getting all the necessary details in a single click

- Chargeback rules: Create chargeback rules with a few clicks and blacklist a user, card, email, IP, etc., automatically.

Summary and key takeaways

Chargebacks lead to high costs and the risk of losing the acquirer contract when the percentage of chargebacks relative to the total number of transactions is too high.

With the proprietary WLPayments’ Chargeback and Dispute Panel, merchants can design their chargeback strategy and decide on their refund policy. The built-in intelligence advises if the transaction should be refunded or not. The time involved in fighting an illegitimate chargeback can be minimised as merchants can access all the necessary data in one place – their gateway portal.

Learn more about our chargeback solutions here and watch the video of our chargeback dashboard. Or fill out the contact form below to talk to our payment specialists and organize a demo.

The secret to a higher risk appetite while safeguarding your MIDs and lowering the chargeback costs