Why You Should Care About Digital Wallets

According to the Worldplay annual payments report, digital wallets are set to be the most popular online payment method by 2023, with a 52% market share. This change is mainly driven by growing digitalization and smartphone penetration, as well as e-commerce market expansion. Thus, this is a payment trend one certainly needs to be aware of and prepared for to stay ahead of the game.

What is a digital wallet?

A digital wallet is a payment system for making e-commerce transactions. Usually, individuals’ bank accounts are linked with digital wallets, which securely store user credentials and banking information. One can utilize this payment method to both make payments online or also in-stores that accept mobile payments. Examples of the most popular digital wallets are ApplePay, Google Pay, Paypal, Venmo, and AliPay.

Now, let’s take a closer look at the reasons why they have become so attractive to both merchants and customers.

For merchants: it’s all about conversions!

As mobile shopping is growing, this presents many opportunities for merchants to increase sales. However, while the m-commerce is on the rise and mobile traffic exceeds desktop, the conversion rate for mobile transactions remains only half of that of desktop transactions. This indicates that customers prefer to browse on a mobile device, but pay on the computer. Surely, when customers switch between devices, this increases the cart abandonment rate and hence leads to lost sales, which is of great concern to merchants. This is where digital wallets can help to increase the conversion rates by providing customers a fast and efficient solution to make the payment on the spot. After all, shoppers are much more likely to complete the transaction when it takes a few clicks, than if one has to bother with entering credit card details manually on a small phone screen. Thus, digital wallets can help bridge the gap between mobile browsing and checkouts, increasing conversion rates for merchants. In fact, BigCommerce found that adding digital wallets, increased the conversion rates three times, while another study found that a PayPal checkout converts at 82% higher rate than a checkout without Paypal. This illustrates the significance of such payment method for merchants wanting to optimize their conversion rates.

Shoppers want fast and secure payments

Not only are digital wallets attractive to merchants, due to higher conversion rates, but they are also appealing to customers who find it to be a faster and more secure payment method. After all, almost 20% of customers abandon their mobile shopping carts due to safety concerns, as many still believe that entering card information on a phone is riskier than on desktop. However, digital wallets can eliminate these concerns, as customers are increasingly viewing them as a more secure payment method. Since wallets do not expose credit card details to the website and tokenization provides advanced security during the whole transaction process, the customers can benefit from more security. Moreover, the usage of biometrics that is often linked with digital wallets provides an extra layer of protection to the customer.

Besides that, digital wallets are also a faster and more convenient payment method, as alluded to before. Instead of having to type in credit card information, shoppers can complete a payment with a few clicks, which is of great value in the fast-paced digital world.

Win-win situation

As discussed in this article, digital wallets are highly beneficial to both merchants and their customers. While merchants reap advantages from higher conversion rates, the shoppers benefit from a faster and more secure transaction process. This can explain the fact why they are growing in popularity and are expected to dominate online payments in the near future. Since digital wallets present a win-win situation and provide an overall improved payments experience, one needs to make sure that the payment platform offers them as a payment option. Lastly, it is noteworthy that working with the correct payments partner ensures the benefit from the digital wallets.

Leave your questions

FEATURED PAGES

All you need to know about Tokenisation

All you need to know about Tokenisation Tokenisation refers to replacing sensitive account and card information with an alternate code, i.e., a “token”, which shall be unique for a combination of card, token requestor, and device. What is a Token? To put it simply,...

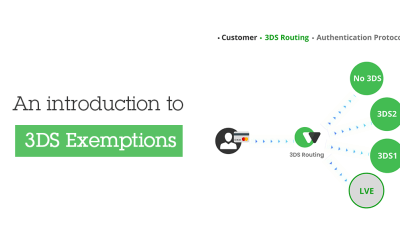

An introduction to 3DS Exemptions

An introduction to 3DS Exemptions Ease of use and better security are two of the most essential characteristics for an online payment transaction. Keeping this in mind, SCA i.e, the Strong Customer Authentication, which came into force from January 2021 in the EU and...

Payment priorities for the forex industry

Payment priorities for the forex industry According to the Triennial Central Bank Survey of FX and OTC derivatives markets, The Forex industry is the biggest financial market globally – even larger than the stock market, with a daily transaction volume of $6.6...