MOTO 2.0: Pay-by-Link and QR Code help manage payments during the coronavirus (COVID-19) pandemic

Millions of companies are feeling the heat by the way the COVID-19 pandemic is being handled. Although all countries have their own policy in containing and battling the virus, most of them are issuing lock-down protocols, leading to the closure of shops and factories with the exception of essential goods and services. Ensuring their companies’ survival during this pandemic, owners are looking at alternative ways of providing for their customers that minimize contact and the risk of getting/spreading the virus.

Searching for new ways to do business

Online sales channels are compensating for some of the lost offline business. However, not every company has those in place, especially small businesses like restaurants often do not have an alternative solution to sell their products. We see dine-in restaurants switching to doing deliveries. People can order the food by phone and get it delivered at their doorstep. Unfortunately, delivery people need to come in close contact with customers that use cash as a form of payment, consequently, risking the spread of the virus.

Furthermore, physical cash itself may currently be one of the strongest mediums for the virus to cling to and spread through a community. It is no secret that cash changes hands several times a day, and, if an infected person is part of this cash cycle, an entire network of people are compromised. What is the solution to this?

Contact less is the new mantra

In an attempt to safeguard their employees, some of the big supermarkets have installed sheets of Plexiglas between the cash register and the customer. Contact between customers and staff needs to be at a minimum, so even for the people that are delivering and receiving packages, an appropriate distance needs to be maintained.

We can expect the current way of living to last for a couple of months, however the anxiety from it all will probably last years. This will lead to a long term, fundamental change in the interaction between businesses and customers. One way to cope with this situation is to find alternatives for the way these transactions are carried out. This is where our payment solution, MOTO 2.0 comes into play.

We are going to ICE London. COME MEET US!

Moto Payments | Helped Managing Payments During COVID-19.

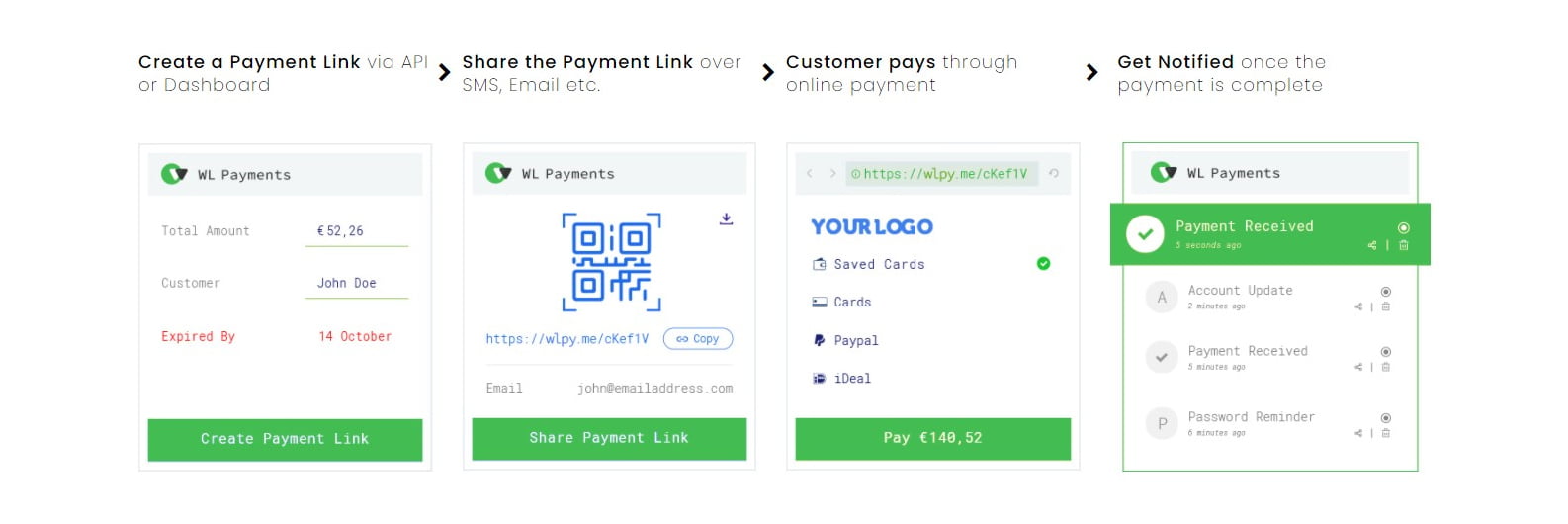

MOTO 2.0 Pay-by-link and QR Code.

MOTO is short for Mail order and Telephone order. A payment solution that offers a way to carry out transactions without the customer having to be physically present. It provides the customers with a fast, secure and professional way to pay for goods and services. The old fashioned way of MOTO required businesses to ask for the customer’s card details in processing them manually hence, it needed the business to be PCI compliant. This is a process that is vulnerable and open to fraud.

Now comes MOTO 2.0. With this there is no need to request for private and sensitive data. An employee of the company can simply generate a payment link and send this to the customer via SMS, Whats-App, Chat-box, or email where then the customer can pay for the transaction instantly with the payment methods that the merchant offers, not being limited to cards only. After the payment is done, the employee checks in real time if the transaction was successful and fulfills his part of the transaction.

Want to learn more about MOTO 2.0 pay-by-link please leave your contact details here

MOTO 2.0: Pay-by-Link and QR Code help manage payments during the coronavirus (COVID-19) pandemic

Leave your questions

FEATURED PAGES

Global Expansion with Payments Orchestration

How a Company Achieved Global Expansion with Payments Orchestration Read the story of one of their merchants. At this company, they have been driven to expand their business globally and tap into new markets. However, as they embarked on this ambitious journey, they...

Hassle-Free Technical Integrations

Hassle-Free Technical Integrations - Fiction or Reality? The Challenges of Payment Supplier Integrations In the dynamic world of eCommerce, one truth remains constant - payment supplier integrations are a necessity for every online merchant. However, these...

Payment Orchestration: building blocks for a great performance

Discover the essential building blocks of Payment Orchestration and streamline your payment processes with ease.Payment Orchestration: building blocks for a great performance In our earlier blog on Payment Orchestration, we discussed how Payment Orchestration is much...