Payment Innovations

Payment

Orchestration

As a merchant you want to operate independent from acquirers and be in the driving seat of your payments strategy.

In control of your own strategy

One integration for all payment methods

Up to date for new rules and regulations

Low code easy integration

Higher success rate is higher revenue

Insightful actionable data

One Engine,

endless routing possibilities:

Country/Region, BIN Range, Volume, and more criteria can be used to determine the most suitable acquirer according to your client needs.

- Country/Region

- Bin Range

- Volume, Ratio

- Currency

- Fee Optimization

3DS Routing for a smooth checkout experience!

Improve success rates, lower costs, and stay compliant with WLPayments’ payment

authentication solution Flex 3DS.

3DS routing allows merchants to decide and implement their own 3DS2 strategy. Namely, merchants can choose which transactions they want to pass on to 3DS2, 3DS1, or no 3DS. This feature routes transactions to the most efficient authentication protocol, taking into account exemptions and other valuable information.

- No 3DS: For regular customers with a small likelihood of chargebacks, merchants can route the transactions to no 3DS, ultimately decreasing checkout frictions and potentially preserving loyal customers

- 3DS2: This is the best way to comply with the SCA regulations

- 3DS 1: if the issuer is not ready for 3DS2, then the transaction will be authenticated with 3DS1

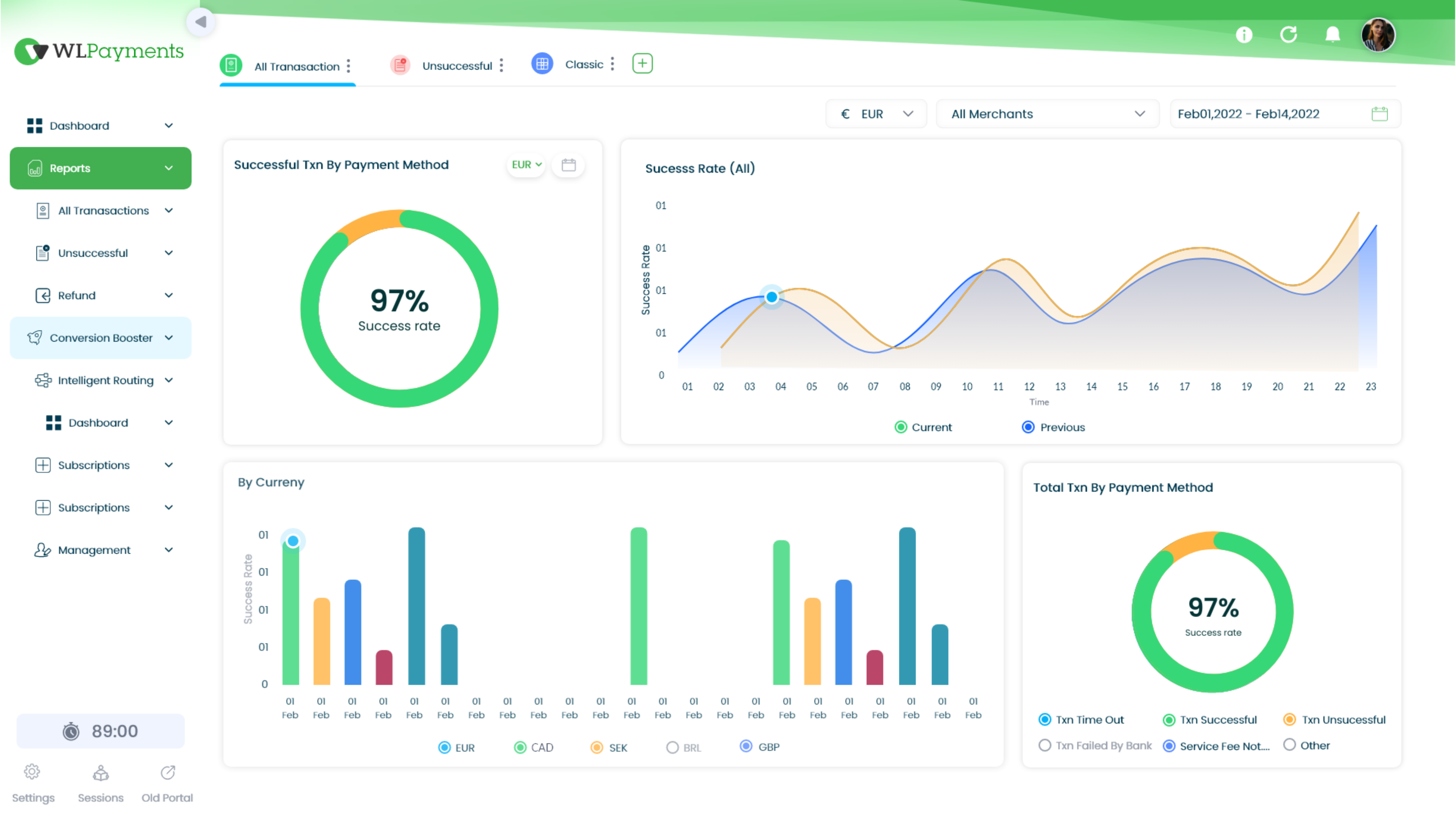

Bring facts to light with In-Depth Reporting

No more slicing & dicing of data – WLPayments provides all the statistics

you need to run your business efficiently.

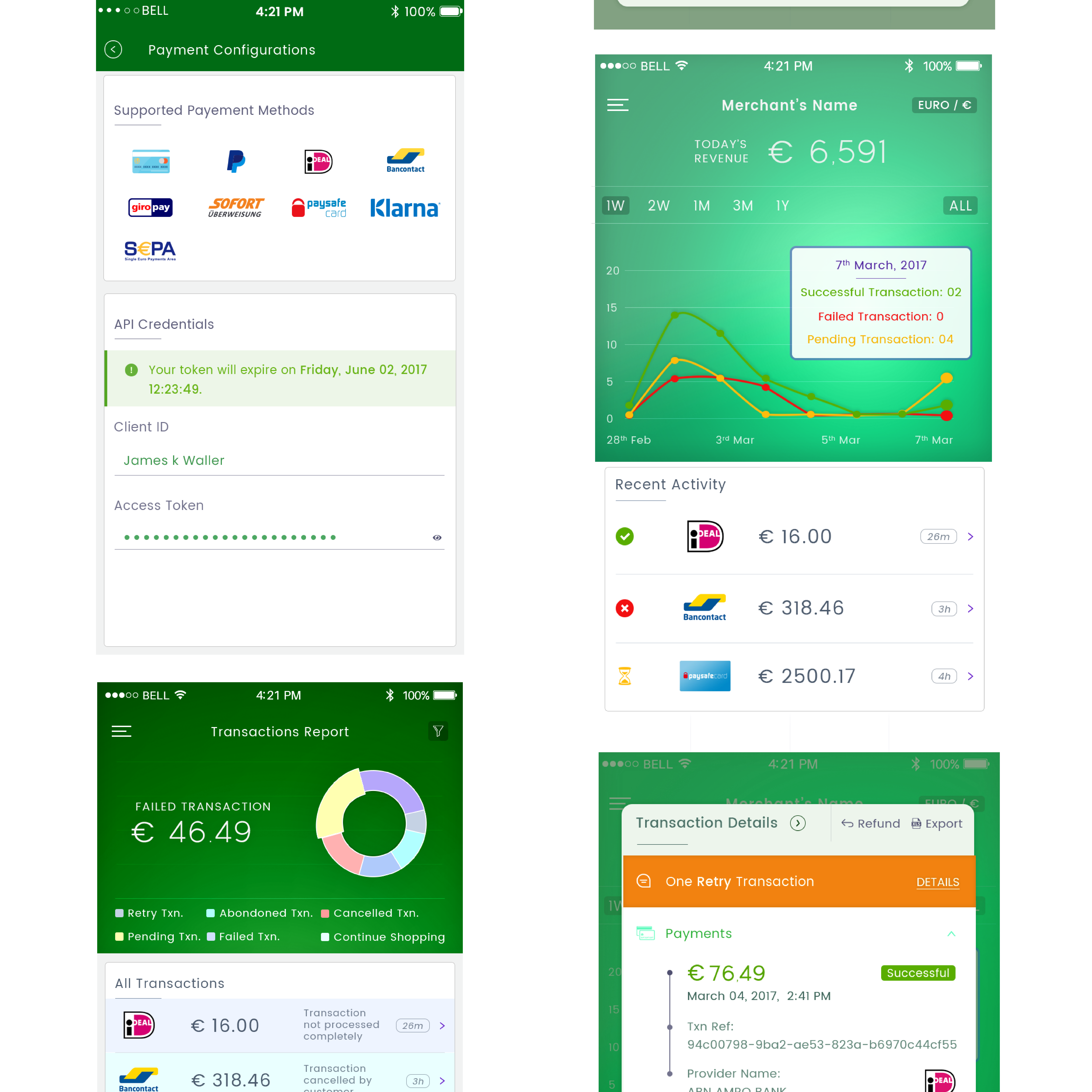

- WLPayments Mobile App: All payments data and actions on your mobile device.

- Device Compatibility: Software built for both iOS and Android.

- Merchant Friendly User Interface: Continuous user feedback results in great ease of use.

- Share All Analytics: Information can be shared from the App using Whatsapp, Slack, email and more.

Mitigate Chargebacks with WLP’s Chargeback Panel

Manage chargeback ratio, safeguard your MID and bring the chargeback

costs down with WLPayments’ chargeback panel

- Chargeback panel for actionable insights

- Chargeback prevention to auto-refund a transaction

- Chargeback guard for accessing details in a single click.

- Chargeback rules to create rules in a few clicks

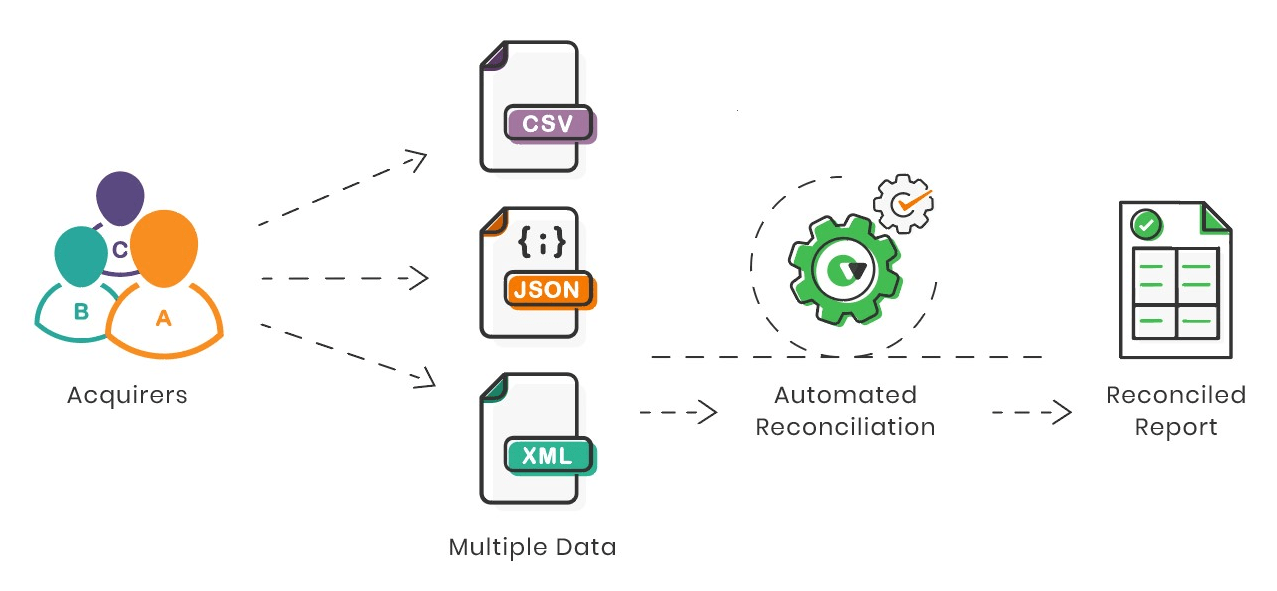

Speed it up with Automated Reconciliation

Simplify and speed up the verification process while making sure

all transactions are being matched and displayed accurately on the reconciliation dashboard.

- Track payments for every order

- Gain insights into all your financial data

- Spot missed transactions and have better visibility on unsettled amounts

- Work effortlessly across multiple acquirers, time-frame policies, and file formats

- Ease the complexity in dealing with refunds and charge-backs