Things you should know before opting for a white label payment gateway solution for your business

What is White Label?

White labelling is essentially the practice of re-branding certain products and services that are produced by one company and then rebranded and resold or used in-house by another company. The vendor company designs a product or offers a ‘plug and play’ service that can instantly be incorporated or resold by your business, after customizing it with your name. The end consumer would perceive that product or service as being offered by the company that rebranded it.

The practice is based on the age-old concept of “trust the experts” – more so, the concept incorporated in an assembly line. Certain individuals will be better and swifter at their job, because of their sheer experience in that niche; similarly, companies that specialize in specific products or services tend to deliver faster, more reliable and substantially advanced results when compared to a business trying to do everything on its own. The aim or purpose of this practice is to conserve the resources in research and development of various diversified but necessary components, focusing on the niche that your business is an ‘expert’ in.

Is using a white label solution appropriate for my business?

Competition is at the core of any commercial sector and there are primarily two ways for a business to get a head – firstly, better equipping your company and secondly, providing an enhanced customer experience. Considering these prerequisites, let us analyse why a business would want to adopt a white label solution in the first place.

- Cost and Time Efficient – As discussed, a product or service being white labelled by your business would be ready for quick deployment. Moreover, it is an aid for reducing your core offering’s time to market, preferably, more than your competition. Having certain services to offer your customers would also be a necessity to sustain your business and going for a white label solution is actually more cost efficient compared to developing it in-house.

- Focus on your core competency – Opting for white label solutions allows you to concentrate on what you do best and saves you the hassle of treading into uncharted territories. In a world of rapid technological advancement, adapting to these changes is an obvious requirement – outsourcing this to white label vendors would be a smart choice.

- Enhances your commercial prospects – A brand’s image is based on the fundamental factor of customer satisfaction. If your customers regularly get an updated, more advanced and easier-to-use way to interact with your business, it results in positive organic growth. Not only does it allow you to land more clients, it can very well result in an exponential growth in profits – absolutely essential to scale your business to the next level.

- Expanding your offerings – Whether it’s bringing on board newer customers or retaining the loyal ones, your business needs to cater to their all-round demands. White label solutions accord you with the opportunity to quickly offer a more diverse range of products that would necessarily keep your customers from going to another brand for a specific field of work.

White labelling in itself seems to be a bright proposition as per our discussion until now. However, it can naturally be characterized by certain issues. As a responsible and ambitious business owner, it is inevitable to take note of those as well. Furthermore, what are the things that a business must keep in mind before opting for a white label solution?

- Look for an experienced vendor with a solid product/service – When you trust another company with developing something that would be used under your business’ name, there cannot be enough room for any doubts. Your brand value is at stake here and remember that going for white labelling was a good choice in the first place due to the concept of expertise. It is thus necessary to look for vendors with a proven track record, a consistent brand image and a well-developed product/ service.

- Focusing on customer service – Remember that incorporating a white label product/service would mean that your company would not have the necessary information regarding the functioning or maintenance of that particular entity. It is absolutely essential in these cases for your providing partner to aid you in understanding their solution and resolving any issues. The importance of your provider would not only be during the provision of a particular product/service but also after the onboarding has been completed. Clear your doubts regarding the customer service provided by your vendor before making a final choice.

- Client-centric approach – It is really important to understand that working with a white label provider is running a marathon and not a sprint. One needs to have a client-centric approach that manifests through their genuine interest in partner growth. This would be evident through case studies or reports published on your vendor’s website, consider going through it. Along with this, it is highly preferable for your white label provider to give you some sort of a tracking mechanism, especially in cases of offering services. All of these characteristics would result in a long-term relationship that would benefit both companies.

- Work culture and professional values – It would be best for your business to partner with a company that has a similar approach towards communication styles, corporate meetings and the overall running of the company. If you believe in a hassle-free informal approach when it comes to resolving issues but resort to professionalism in terms of carrying out necessary tasks for your business, it would be better to work with someone similar. Analyse how your issues get resolved or how a concept is explained to you while you interact with your prospective vendor. Having a similar business environment increases the chances for both companies to align well.

Why choose a White Label Payment Gateway?

As the concept of white labelling is clear to us, along with its benefits and the general precautions to be observed while entrusting a partner with the same, we will address the question of why to opt for a white label payment gateway in particular?

- Catering to Customers’ Expectations – Your business offers a great product; the customer has decided to go ahead with it and has proceeded to make the payment and avail your services. The only way that they are going to have even a speck of doubt is if this gateway payment isn’t made in a hassle-free manner. On the other hand, having a good direct payment gateway interface that works efficiently and satisfies your customers will automatically make them trust your company. Why is this the case? In the world of e-commerce, where there is limited human interaction, a customer will always be sceptical of their payments. A well-run payment gateway accords them with the necessary trust in your business.

- Brand recognition – Every time a customer completes their transaction with ease or notices a regularly updated payment interface that caters to them, it is going to add to the brand value of your business. A trusted vendor is supposed to incorporate innovative technology in its payment gateway systems. This shows that not only does your business stay relevant in terms of upgrading itself but also, it deeply cares for its customers. Also, a white label payment gateway solution, in particular, works under your company’s name in contrast to a general gateway system. This further enhances your brand’s image.

- Better relationships with merchants and acquirers – If your platform acts as a link between merchants and customers, a direct payment gateway will also serve the purpose of being a merchant gateway. It allows them to track their payments and be reassured of loss prevention that could arise due to fraud. An experienced white label payment gateway provider will also establish a good relationship with acquirers, which are essentially banks that process the said payments. This association can be a highly tedious task if managed by your company on its own.

- Cost-effective and flexibility – A payment gateway is a necessity for a company operating in any form of e-commerce. Given the compulsory nature of the service of gateway payments, it is always better to make it as cost-effective as possible. White labelling the payment gateway effectively allows for the best possible solution at the best possible price which would be very difficult to achieve with a ‘hit and trial’ method of in-house development. Furthermore, a white-label service provider would provide you with the flexibility of customization that will be absent in regular gateways.

Things you should know before opting for a white label payment gateway solution for your business

Criteria for a white label payment gateway WLPayments White Label Payment Gateway | Things to Consider Before Choosing

Priority expectations from your payment gateway provider

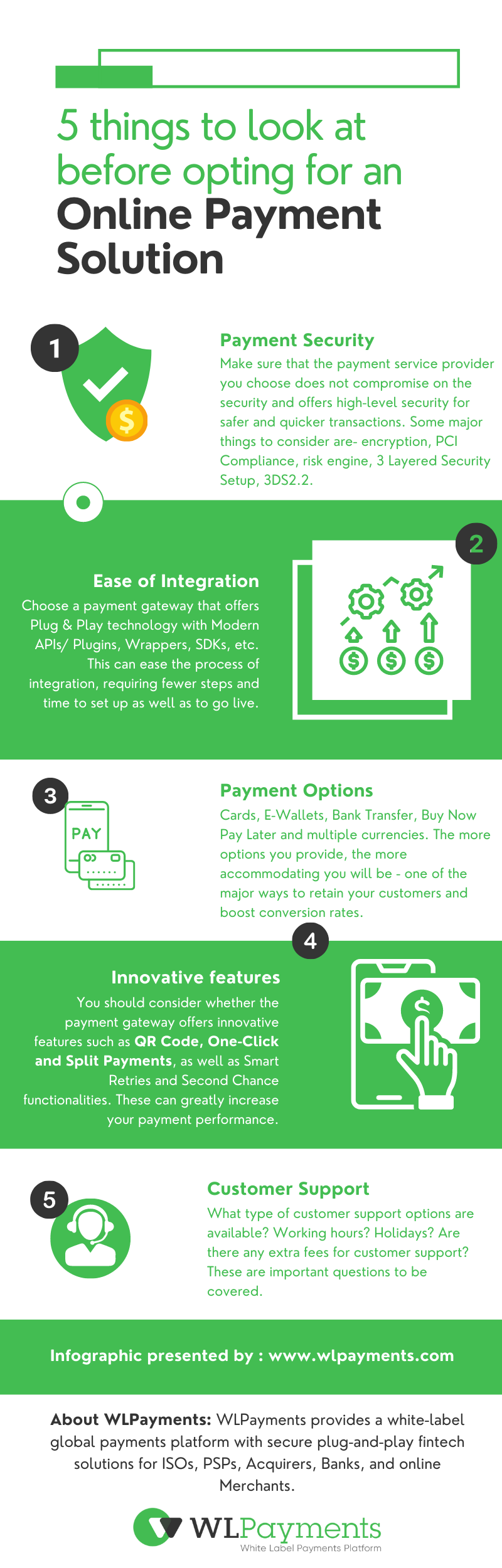

After obtaining clarity on the concepts of white labelling, its advantages and the need for a white-label payment gateway platform, it is essential to consider the following points when choosing the right one for your company.

- Smooth onboarding with a reasonable development time – Look for vendors that create a simple and stress-free process of onboarding and integration with your online business. Although the product is readily available, there might be specific tweaks required before adopting the gateway; thus, one should ensure that the vendor can do this in a reasonable time.

- Payment Gateway Encryption and adherence to PCI standards- Essential company information is shared when opting for a white label payment gateway solution, Therefore, it is necessary that you opt for a PCI DSS compliant gateway. PCI compliance essentially aids in preventing security data breaches since PCI standards are formulated considering the importance of privacy for a business. DSS would help in the decision-making procedures by an efficient analysis of gathered data. Both of these are prerequisites for a trustworthy payment processing gateway.

- Relationship with merchants and acquirers – Look for vendors with a long-term and robust relationship with both merchants and acquirers. This shall ensure unfettered and smooth gateway payments. The last thing that your business wants is corporations or individuals being unsatisfied with your partner as that could drastically affect your business prospects.

- Monitoring system – A good white label payment processing gateway would include a product that allows you to monitor and manage your gateway payments, track their frequency and keep a note of other essential details. Realizing the importance of data analytics is an absolute necessity in the information age.

- Interface, Security and Training materials – The interface, although customizable as per company requirements, should have a generally sorted feel from the beginning. Along with the technicalities, ensure that the vendor caters to the aesthetic needs of the product as well. Along with this, there should be no compromise on payment gateway encryption and security. All of these details must be made readily available by the vendor ensuring smooth adaptation to their product/service.

- Types of merchants that the payment gateway allows – Ideally, there shouldn’t be a bar on the type of merchants that you as a company can work with. Your direct payment gateway must provide you with the freedom to work with the merchants that you want to be in business with and provide services in the verticals of your niche. It should conform to the needs of being both a payment processing gateway and a merchant gateway.

- Relationship with acquirers – Ensure that your payment gateway provider has a trustworthy relationship with payment acquirers. An agnostic approach in this regard suits the swift payments as there are a host of channels to support the transaction aiding in a good success rate of payments.

Advanced payment gateways also come with added services like recurring billing, fraud protection, enhanced payment gateway encryption and tokenization – all of this aids the financial functioning of a company.

Finally, taking absolute care of the discussed considerations and being cognizant of necessary information while opting for a white label payment gateway solution will certainly go a long way in benefitting your business. The right partner in this regard can actually propel your company to provide an enhanced standard of service, better serve your customers, being ahead of your competition along with being able to better focus on your own product.

Leave your questions

FEATURED PAGES

Innovative Technology Solutions for Payment Orchestration

Innovative Technology Solutions for Payment Orchestration Payment orchestration is a technology solution that enables merchants to manage multiple payment channels, acquirers, and gateways through a single platform. WLPayment’s platform acts as a centralised hub for...

ICE x WLPayments

We are going to ICE London. COME MEET US!DIve into the world of payments and technology with us and book a meeting to explore more!7th-9th February, 2023Efficient Payment Fraud management in the iGaming space The most important component of any iGaming business is to...

Payment Analytics for Gateways and Acquirers

Payments Analytics for Gateways and Acquirers Payment gateways and acquirers play a vital role in the online payment industry. They facilitate the transfer of funds between merchants and customers and take care of the exchange of data between the participants to...