Six Payment Priorities for the iGaming Industry

In our previous blog, we explored the importance of fraud mitigation for payments in the iGaming industry. However, it is important to stress that implementing fraud prevention tools alone are not enough. Fraud management must work alongside efficiency-boosting solutions to make sure that a seamless payment experience goes hand in hand with strong compliance. Hence this blog will discuss the various payment solutions and features that are important complements to anti-fraud solutions in the iGaming industry.

Wide range of payment methods

It is essential for iGaming merchants to be able to offer a wide range of payment methods in order to stay competitive in the industry. The fact that industry regulations differ heavily across countries poses difficulties, specifically in terms of cross-border payments and international business expansion. Moreover, besides different regulatory frameworks across countries, another driver for the demand of having numerous payment methods is the customer’s expectation of a seamless payment experience. Fulfilling this expectation is essential in order to keep the customer focused on the game. When a customer is able to pay instantly with their preferred payment method, he or she can put all of his attention to the content and fully enjoy the gaming experience.

Considering these drivers, a successful iGaming operator must complement traditional card offerings with alternative payment solutions such as e-wallets, crypto and open banking. The latter two have lately become a must-have for operators. Rapidly growing attention to personal privacy, possibility to minimize transaction fees and enjoy blockchain-assured security makes crypto a payment method of choice for many iGaming customers. Furthermore, faster access to funds and increased conversion are the core benefits why customers prefer open-banking solutions over card payments. By offering these payment methods, merchants ensure that they are able to supply the most innovative and fastest payment experience to their customers.

Finally, iGaming merchants with international ambitions must have the selection of favourite local payment methods. This allows them to operate and expand into different countries, in each of which the preferred way of paying is different (see our overviews for Nordics, EU and LATAM).

Payment orchestration layer for cost-efficiency and business continuity

When partnering with a payment gateway it is always wiser for iGaming companies to choose one with a multi-acquirer setup. With the large amounts of traffic they have to manage, any outage or technical hold-up on the acquirer’s end can severely impact business continuity. Hence, with a multi-acquirer setup, the risk of outages is spread across multiple parties. This ensures the smooth, uninterrupted functioning of the company’s transactions with the use of cascading. Cascading allows failover transactions to automatically be sent to a secondary acquiring bank. Risk diversification in this form is highly encouraged, especially for this industry. Read more on this subject in our blog: Multi acquirer v/s single acquirer: Which to choose?

Additionally, as an efficient way to decide on acquirers for each transaction, one can also configure Intelligent transaction routing (ITR). ITR has been known to optimize every transaction by maximizing its success rate and minimizing its cost. Read more on this subject in our blog: What you should know about Intelligent transaction routing.

Quick integrations and strong support

Let us not forget the most important step in an iGaming company’s journey. Online gambling companies should look for payment gateways that offer quick and easy plug-n-play API integrations. Connection with various payment solutions, technologies and acquirers should happen in a matter of hours and days rather than weeks and months. Since iGaming operators compete in such a regulation-driven and fast-changing industry, choosing the payment partner which is the most agile is critical. Apart from fast integrations, the payment provider’s support team must be able to react to any payment-related issues in a matter of minutes. Choosing the gateway provider with a technically talented, and, essentially, highly dedicated support team is the crucial step towards success in the iGaming industry. We at WLPayments pride ourselves on our support record for clients and integration speed for new processors.

One-click payments for speed

iGaming companies can now enable their players to top-up their wallets and get back to the game quickly and without friction. This is made possible by integrating a one-click payment solution that relieves players of a long check-out process. Moreover, a good payment gateway should not only offer an intuitive in-app checkout experience for customers, but also monitoring and management apps for the iGaming company. So while the players top-up their wallets, the merchants can monitor and manage their one-click payments through real-time notifications on the app. Such a solution has the power to significantly improve customer retention, boost conversions, and reduce app abandonment rates. Overall, by simplifying the payment process for its users, iGaming companies can build a better long-term relationship with their audience. Evidently, this is an integral part to boosting short- and long-term customer success. You can read more on this subject in our blog: One-click payment in the Modern E-commerce Ecosystem.

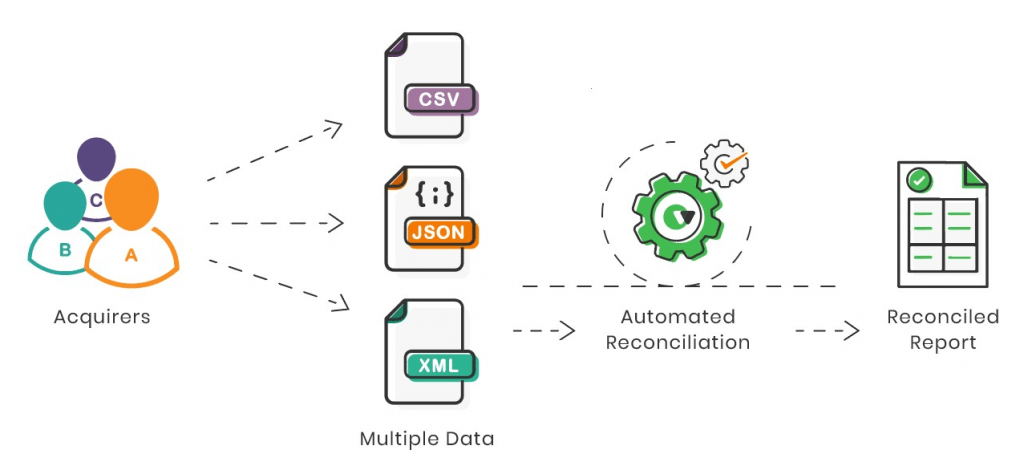

Automatic reconciliation

As an iGaming company grows, it begins to deal with a growing amount of transactions, as well as increasingly complex regulations around client money segregation. In order to stay compliant, iGaming companies require accurate reporting together with a strong audit trail. Moreover, with customers spread across the globe, these transactions occur in different currencies, using different payment methods and devices. Having to reconcile such vast volumes of transactions in varying currencies through channels with different fees is far from a simple process. As the volume of transactions grows, it is important to partner with a payment platform that combines flexibility and technology when creating a completely automated reconciliation system. This system should be designed to help iGaming companies track their payments for every transaction completed, saving them the headache of having to manually reconcile everything on a spreadsheet. Not only does this increase the company’s day-to-day efficiency but it also gives them better insight into their financial data and allows them to stay compliant.

Cross-device and cross-browser compatibility

Online gambling is moving to mobile, that is for sure. For instance, 37% of online gamblers in the US, UK and Australia play casino games on mobile devices. Most online games are being offered through apps, which provides convenience and simplicity for the user. Moreover, online gambling games have relatively low graphic demands compared to other gaming activities. This, coupled with structural influences such as 5G, Covid-19 pandemic and growing mobile device use indicate that the future of iGaming is mobile.

Thus, it is essential for iGaming operators to partner with a payment provider whose payment pages are fully compatible across all kinds of devices (desktop, mobile and tablet) and browsers. Only then they can ensure that their business is ready to exploit a strong and growing trend of mobile iGaming services and serve all customers that still access the game through desktop in different browsers.

Conclusion

By now we fully understand the need for iGaming companies to update their payment technology. Each of the aspects mentioned in this blog is crucial for customers’ payment experience, and thus to the large extent the commercial success of an operator. The underlying idea of our two-part blog is clear: players in the industry must carefully choose the payment provider that can provide both fraud prevention and efficient payment processing features. Only then sustained growth and customer retention can be ensured.

Connect with Us

FEATURED PAGES

The secret to a higher risk appetite

The secret to a higher risk appetite while safeguarding your MIDs and lowering the chargeback costs Merchants benefit from the WLPayments’ machine learning-powered chargeback module through its partnership with EthocaTM What risks do merchants run with chargebacks?...

Trends in Global Payments for 2022

Trends in Global Payments for 2022 As we enter this new year still in the midst of a pandemic, it is vital for payment companies to foresee digital payment trends and plan ahead of time. The best way to predict customer patterns and preferences is to follow the...

WLPayments adds eight new integrations in the first quarter of 2022 to its fast-growing portfolio of payment partners

WLPayments adds eight new integrations in the first quarter of 2022 to its fast-growing portfolio of payment partners WLPayments is pleased to announce that they have completed eight additional integrations since the start of the year, allowing merchants to further...